Silicon Valley Bank (SVB) is a leading financial services company that caters to the needs of the tech and startup communities. The company has been in the news recently due to an issue related to the handling of a particular client's account. In this article, we will delve into the details of this issue and its broader implications.

Background

The issue in question relates to the account of a Chinese scientist named Juan Tang, who was a visiting researcher at the University of California, Davis. In July 2020, Tang was accused by the FBI of visa fraud, and SVB froze her account, which held her salary and savings. Tang's lawyers claimed that SVB had acted unlawfully, and filed a lawsuit against the bank.

SVB's defense was that it had been advised by the FBI to freeze Tang's account, and that it was obligated to comply with law enforcement agencies. However, Tang's lawyers argued that the bank had no legal basis for freezing the account, as there was no court order or warrant.

The case was closely watched by the tech and startup communities, as SVB is a key player in providing financial services to these sectors. Many were concerned that the incident would undermine trust in SVB and discourage entrepreneurs from working with the bank.

Implications

The Tang case raises several important issues related to the role of financial institutions in law enforcement. Banks have a legal obligation to report suspicious activity to authorities, such as money laundering or terrorism financing. However, there is a fine line between fulfilling this obligation and violating the privacy and rights of their clients.

In the case of Tang, SVB's decision to freeze her account without a court order raises questions about the bank's responsibility to its clients. It also highlights the potential risks that arise when banks are too quick to comply with law enforcement agencies, without sufficient legal basis or due process.

The case also highlights the broader issue of US-China relations, and the challenges that Chinese scientists and researchers face in the US. The Trump administration's "China Initiative" has heightened scrutiny on Chinese researchers in the US, leading to a number of high-profile cases like that of Juan Tang.

In the tech and startup communities, there is concern that such incidents could discourage collaboration between US and Chinese entrepreneurs, and harm innovation and economic growth.

Response

SVB has faced criticism for its handling of the Tang case, with some arguing that the bank was too quick to comply with law enforcement agencies, and did not sufficiently consider the rights of its client. In response, SVB has emphasized its commitment to privacy and due process, and has stated that it will review its policies and procedures to ensure that they are in line with legal and ethical standards.

The Tang case has also prompted broader discussions about the role of financial institutions in law enforcement, and the need for clearer guidelines and regulations. Some have called for greater transparency and oversight of banks' interactions with law enforcement agencies, in order to protect the rights of clients and ensure that due process is followed.

Conclusion

The SVB-Tang case is a complex and multifaceted issue, with implications for the tech and startup communities, as well as broader issues related to US-China relations and the role of financial institutions in law enforcement. While the outcome of the case remains uncertain, it has highlighted the need for greater clarity and transparency in the relationship between banks and law enforcement agencies, and the importance of protecting the rights and privacy of clients.

In addition to the Juan Tang case, Silicon Valley Bank (SVB) has also been in the news recently due to an issue with its partnership with Etsy, an e-commerce marketplace for handmade and vintage items.

The issue arose when a number of Etsy sellers reported problems with their accounts and payments, with some even claiming that they had been permanently suspended from the platform without warning or explanation. After investigating the matter, it was discovered that the problem was related to SVB, which had been processing payments for Etsy since 2016.

According to reports, SVB had implemented stricter anti-money laundering (AML) policies, which resulted in a higher number of flagged transactions and account suspensions. While SVB stated that it was simply following regulatory requirements, many Etsy sellers were frustrated with the lack of communication and transparency from the bank.

In response, Etsy announced that it would be partnering with Shopify, another e-commerce platform that uses a different payment processor, in order to provide more reliable and transparent payment services to its sellers. The move was seen as a significant blow to SVB, which had built a strong reputation as a financial services provider for the tech and startup communities.

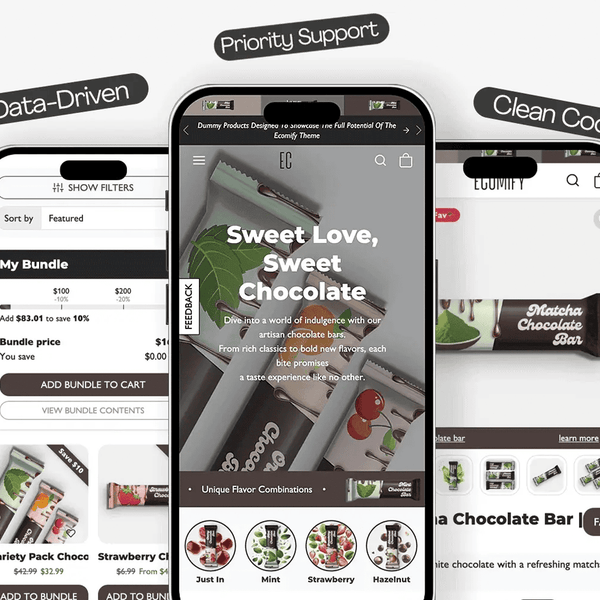

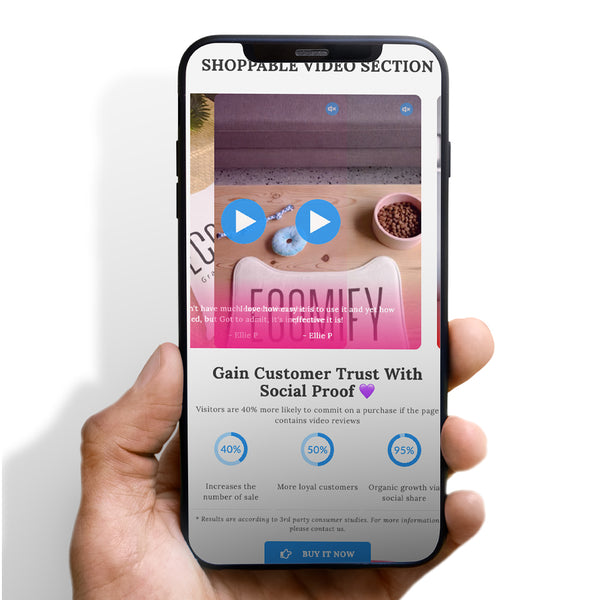

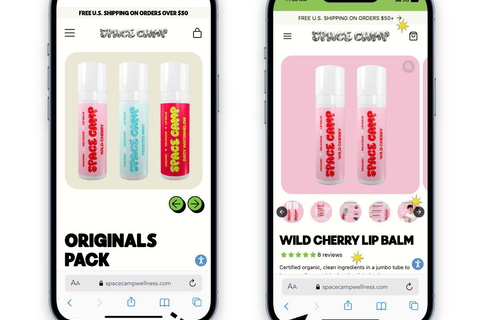

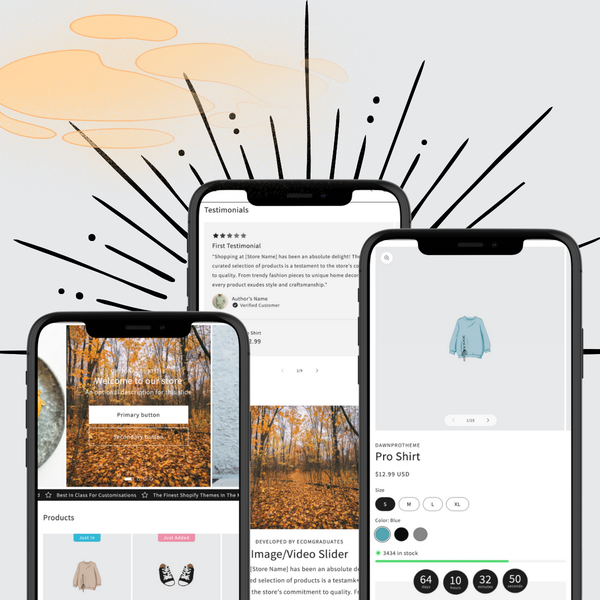

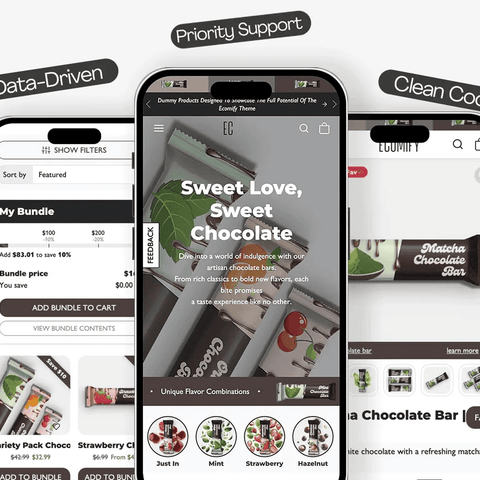

So, how can Shopify help in this situation? One key advantage of Shopify is that it uses multiple payment processors, rather than relying on a single provider like SVB. This means that if one processor is experiencing problems or implementing stricter policies, Shopify can quickly switch to another provider without disrupting the platform or its sellers.

In addition, Shopify has a reputation for providing transparent and user-friendly payment services, which could help to address some of the concerns raised by Etsy sellers about the lack of communication and support from SVB. By partnering with Shopify, Etsy can offer its sellers a more reliable and consistent payment system, which in turn could lead to greater trust and confidence in the platform.

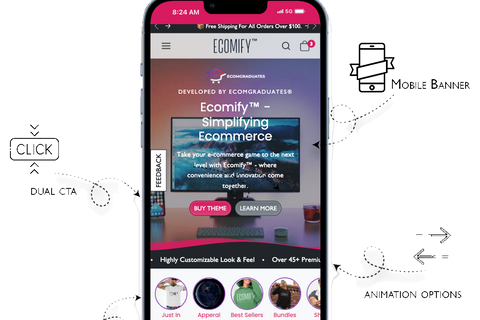

Start today for $1 for 3 months

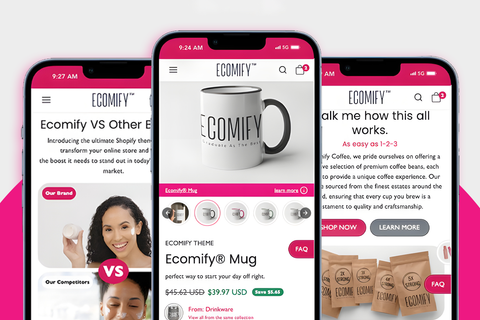

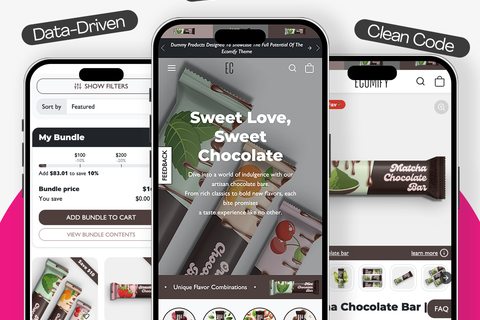

Get started today with our Custom Shopify theme for 25% OFF

Using ETSYTOECOMIFY at checkout

https://ecomgraduates.com/products/ecomify-premium-shopify-theme

5/5 from 144 reviews

5/5 from 144 reviews